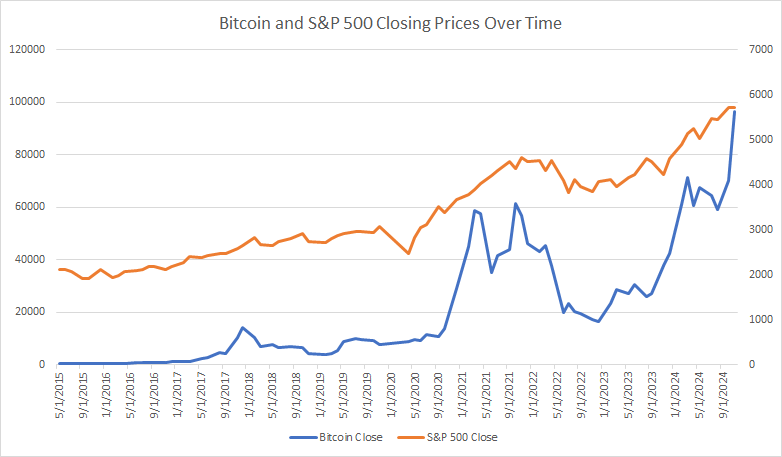

Proponents of cryptocurrency often claim that Bitcoin, as a decentralized asset not tied to any state or central bank, is insulated from the fluctuations of the broader economy. I am skeptical of this assertion. Given that crypto as a whole is now a significant asset class, and Bitcoin has been a significant asset for some time, we now have sufficient data for a preliminary analysis. I downloaded historical price data from 2015 to the present for Bitcoin and the S&P 500, cleaned it using R, and used Excel to create the following chart and perform a basic statistical analysis.

The chart reveals that Bitcoin closely tracks the S&P 500, though with greater volatility. A correlation analysis yields a coefficient of 0.91, indicating a strong positive relationship. These preliminary findings lead us to reject the null hypothesis that Bitcoin is uncorrelated with the market. Thus, the claim that Bitcoin serves as a store of value immune to market fluctuations is likely false.